Search by keywords

Filter by Category

Filter by Tag

Posted on 02/12/2025

Posted on 01/12/2025

Posted on 01/12/2025

Posted on 01/12/2025

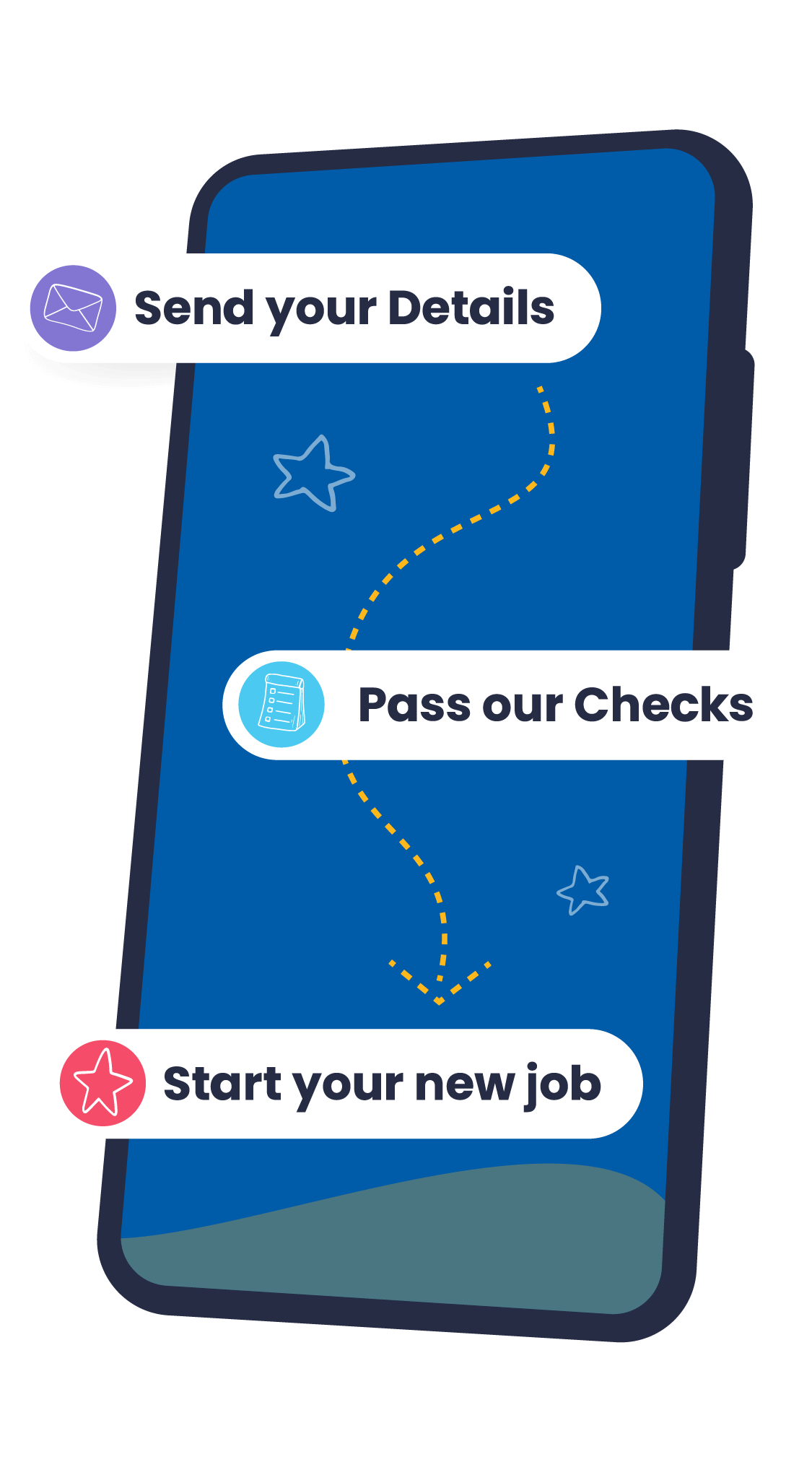

Ready to get started?

The next step is to send us your details. If you’re suitable, a consultant will be assigned to help you and will be in touch as soon as possible.

The next step is to send us your details. If you’re suitable, a consultant will be assigned to help you and will be in touch as soon as possible.